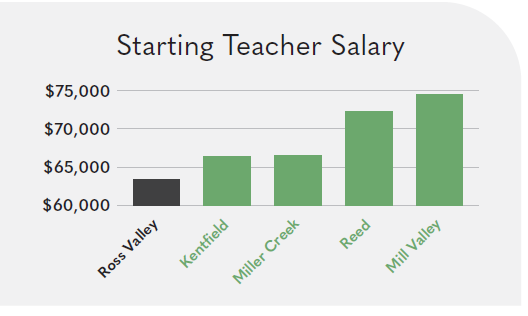

Ross Valley Teachers Are Among the Lowest Paid in the Area

Teachers at Ross Valley School District are among the lowest paid in Marin County— one of the most expensive counties in the State. Lower salaries may result in a loss of high-quality local teaching staff to neighboring districts that offer more competitive pay.

Locally Controlled Parcel Tax Funding For RSVD

The Board of Trustees recently voted unanimously to place a 52 cent per building square foot measure on the May 6 special election mailed ballot to renew RVSD’s existing parcel tax authority. If approved, this measure would distribute the tax burden across the entire community, with large commercial property owners paying more than smaller single-family homes. Funding from this measure could be used to:

- Attract and retain qualified local teachers

- Maintain small classroom sizes for all grade levels

- Protect core academic programs in science, technology, engineering, and math; and reading and writing

- Preserve school libraries and library services

Mandatory Fiscal Accountability and Local Control

If approved by voters, the measure would be subject to fiscal oversight as mandated by law:

- All money would be controlled locally and could not be taken away by the State

- Independent citizens’ oversight and mandatory annual audits would help ensure funds are spent as intended by voters

- Senior citizen and certain disabled homeowners would be exempt

- No money raised could be used for administrators’ salaries or pensions

- Distribution of tax burden across our entire community, with large commercial property owners paying more

Learn More!

As RSVD plans for the future, the District welcomes input from RSVD families and community members alike. If you have any questions about the measure, contact tgraff@rossvalleyschools.org.

Additional Resources